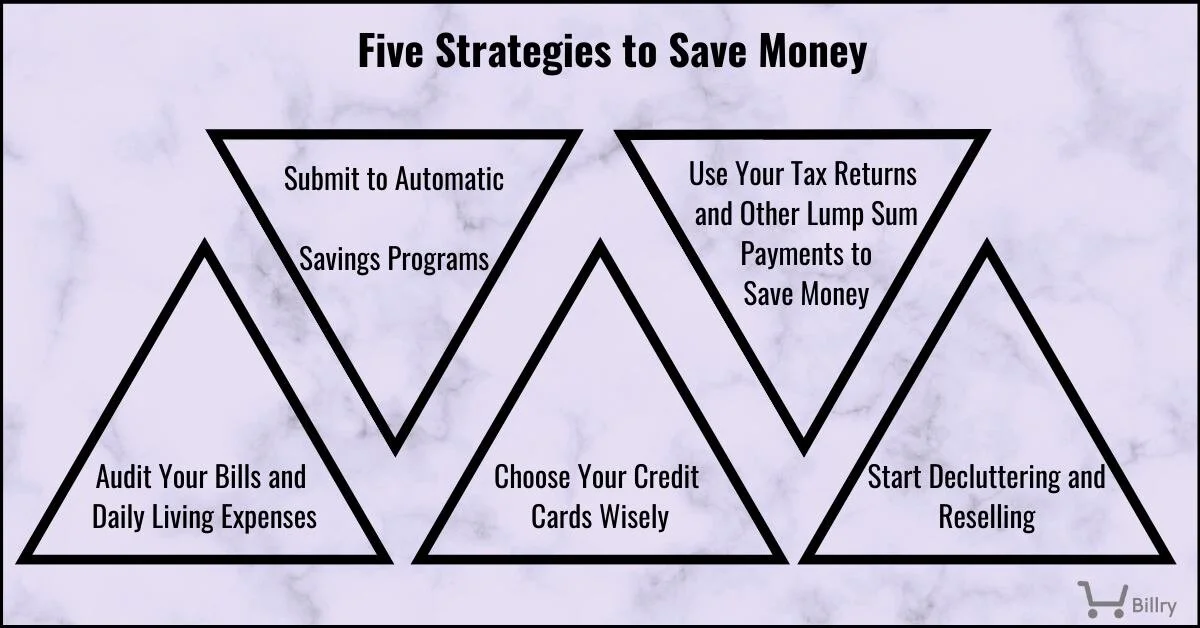

Key Takeaways

- Budget-conscious consumers are finding new ways to save on daily expenses.

- Tech tools and traditional tactics can work together for better savings.

- Combining coupons, cashback, and rewards maximizes your purchasing power.

- Staying updated on digital deal apps and seasonal sales can lead to extra savings.

- Being intentional about purchases fosters financial well-being.

Why Saving On Everyday Purchases Matters

The landscape of everyday shopping is changing fast, with pressure on household budgets mounting. For many, necessities like groceries, cleaning products, and toiletries consume more monthly income than ever. According to the U.S. Bureau of Labor Statistics, an average American household spends more than $8,000 a year on food at home and away, which can quickly strain resources, especially as prices fluctuate due to inflation and supply chain challenges. That’s why adopting smart spending habits and using savings opportunities, such as a Target promo code, can make a meaningful difference in the present and future.

The ripple effect of intentional budgeting goes beyond immediate savings. Over time, a few dollars saved here and there accumulate, helping fund unexpected expenses, medical bills, or even special family moments. Small, consistent savings can be a buffer, making life’s inevitable surprises less stressful. When shoppers become more strategic, they often report improved confidence, enhanced ability to invest in long-term goals, and less anxiety at the checkout line or online cart.

Building A Savings-First Mindset

Adopting a savings-first mindset requires more than chasing a handful of discounts—it means reshaping your approach to shopping altogether. Instead of making last-minute buys or giving in to digital ads, seasoned savers invest time in planning. This often starts with a written or digital shopping list of necessities, ranked by urgency. Identifying what’s needed versus what’s nice to have makes it easier to outline clear spending limits and avoid costly impulse decisions.

Developing this proactive attitude may mean mapping out meal plans, setting alert reminders before seasonal sales, or double-checking household stock before shopping. Many shoppers even set personal savings challenges, such as cutting $10 off the weekly grocery bill or skipping one restaurant meal per week. These achievable goals add up, consistently freeing cash for more essential purchases or long-term savings. Over time, this mindset shift—paired with small, realistic goals—becomes deeply ingrained, empowering consumers to feel in control of their finances rather than at their mercy.

Using Technology To Find Deals

The rise of digital platforms has revolutionized how people uncover bargains in every shopping category. With countless options now available, browser extensions can automatically fetch and apply valid promo codes at checkout without manual searching. Apps notify you of lightning deals, personalized discounts, and exclusive offers when they become available. Savvy consumers who follow trusted shopping guides and leverage these digital tools have reported massive improvements in their ability to save.

Staying current with digital deal apps adds another layer of potential. Mobile apps not only track price fluctuations but also price drops, restocks, and limited-time flash sales. Many retailers now offer in-app rewards and special discounts not found in-store or on their websites. According to a recent survey, more than half of regular mobile shoppers claimed apps had helped them save money on a purchase within the past month. Utilizing technology makes deal-hunting less time-consuming and much more effective, assisting users to sidestep overpaying while increasing convenience at every step.

Stacking Savings: Coupons, Cashback, And Loyalty Programs

The art of stacking savings lies in combining multiple offers and rewards for a single purchase, turning an ordinary shopping trip into a real win. For example, one might first apply a manufacturer’s coupon—whether in paper or digital form—to score a discount. Next, one could log into a retailer’s loyalty program for exclusive member deals or bonus points. Topping it off, shoppers often use a rewards credit card offering cash back or points, further compounding the savings.

Some compelling real-world success stories involve parents outfitting their kids for the back-to-school season or restocking an entire pantry. By checking for digital coupons, activating store offers in an app, and making purchases with a cashback card, it’s common to see discounts stack up to 20–30% or more. Savvy shoppers habitually subscribe to promotions, organize and log in for loyalty programs, and constantly review and stack policies. Stacking may require a little organization, but the payoff is often well worth it, and over a year, it can help families or individuals save hundreds of dollars.

Timing Your Purchases For Maximum Value

Strategic shoppers have learned that the “when” can matter as much as the “what” during shopping trips. Sales cycles, end-of-season clearances, and retail holidays can all dramatically influence price, sometimes slashing costs by half or more. Data from industry analysts shows that waiting just a few weeks for seasonal products, like winter coats in early spring or swimwear in the fall, can yield sizable markdowns.

Subscribing to promotional newsletters or setting calendar alerts before expected sales events, such as Black Friday, Labor Day, or semi-annual clearances, puts control back in the shopper’s hands. A history of comparing prices and observing patterns means you’ll rarely need to pay full price. When consumers take a long-view approach, even big-ticket items and recurring expenses, such as electronics or school supplies, become far more affordable, freeing up extra cash for other priorities.

Shopping Responsibly In The Digital Age

As digital deals proliferate, consumers must shop carefully to stay protected. One vital step is to verify sellers, especially on larger third-party marketplaces, by reading reviews and double-checking feedback ratings. Knowing return and price-match policies saves time (and frustration) if you need to change or return a purchase. Locking down your online security, such as using two-factor authentication and secure payment methods, further guards against unauthorized charges or scams.

Responsible digital shopping also means tracking your purchases and verifying that discounts or rewards have been applied adequately before completing any transaction. Save receipts, confirm emailed order details, and use encrypted payment systems when possible. The goal is to maximize every deal while keeping your identity and funds safe, turning shopping into a smart, low-risk experience.

Real-Life Examples Of Budget Success

Consider Lily, a college student who once viewed shopping as a necessary stressor. After downloading price-comparison tools and committing to a weekly food budget, she learned to prioritize essentials and avoid waste. Lily saw consistent savings of $50 to $100 per month, money she now puts toward textbooks and occasional outings.

The Menendez family offers another example. By syncing grocery runs with digital flyer deals and redeeming manufacturer coupons, they’ve freed up hundreds of dollars each year for extracurricular activities and family trips. Their method shows that a blend of planning and flexibility pays off: they stock up when staples are discounted and delay non-urgent purchases until the best price appears.

Stories like these illustrate the diversity of fundamental savings strategies—each personalized for individual needs and lifestyles. The common thread is a commitment to mindful shopping and a willingness to try new tactics. Disciplined choices can significantly boost your bottom line, whether you’re budgeting for yourself, a roommate, or a busy family.

Final Thoughts: Making Every Dollar Count

Today’s cost of living means every dollar counts even more. Combining a proactive savings mindset, modern technology, and proven stacking techniques can turn shopping from a drain into a delight. By planning, leveraging the plethora of digital resources, and embracing responsible shopping habits, consumers save money and gain peace of mind and financial resilience. In a world where prices change, these thoughtful strategies help make the most of your hard-earned income and ensure you’re always ready for whatever life throws your way.